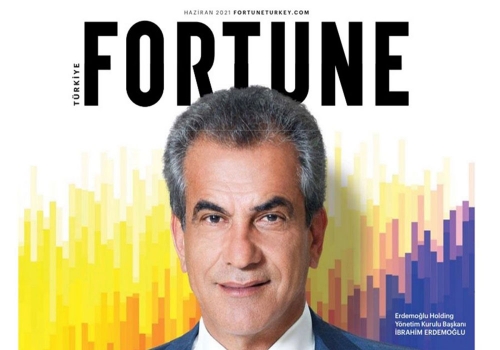

İbrahim Erdemoğlu says that with the PTA investment of SASA Polyester, it will become one of the most advanced facilities in the world in terms of energy efficiency, technology, and automation.

Racing to global leadership with its state-of-the-art world class production facility, SASA Polyester is preparing intensely for the harsh competition rules of the future with its technology infrastructure, unique product development strategy and international quality standards. SASA Polyester AŞ, one of the world's leading polyester producers, plans to increase employment and become the polyester production base of the region and Turkey with its Purified Terephthalic Acid (PTA) and fiber investments. How? By providing significant growth in investment plans for the last four years... Investments in the facility they took over from Sabancı Holding in 2015 continue without losing pace. With SASA Polyester, it increased its polyester production capacity from 350 thousand tons to 1.4 million tons, and its annual turnover from 1.2 billion TL to 5 billion TL. More than four-fold growth in sales SASA aims to become the polyester production base of Turkey and the region with its fiber and PTA plant investments. And it achieved it. The POY/Yarn facility was commissioned in June 2020, and the Polyester Chips facility in September 2020. Net sales for 2021 are targeted at 11 billion TL. Erdemoğlu Holding Chairman of the Board İbrahim Erdemoğlu, says that the world's largest capacity and highest efficiency PTA facility on a single line will be established in Adana as SASA Polyester Sanayi A.Ş. He says that they plan to commission the 1.58 million tons/year capacity PTA facility in their Adana production facility in February 2023. Erdemoglu says “The investment cost of this facility, together with its auxiliary businesses, will be approximately 935 million dollars. While our PTA facility has the highest single line capacity in the world, it will also show the best performance in terms of raw material usage and energy efficiency."

Environmental practices are also realized in the PTA business along with efficiency. With its waste water treatment plant, the enterprise reuses approximately 10 million tons of water annually.

Erdemoğlu also gives an example: "The heat energy released by chemical reactions in the enterprise will be converted into electrical energy, and after the enterprise meets its own needs, we will export approximately 10 M Watt/hour energy to other enterprises of SASA."

SASA Polyester reached a production capacity of 1.4 million tons as of the end of last year in polyester production. This capacity stands out as the highest capacity after of China and India. Erdemoğlu says that despite this capacity, Turkey's import of only finished polyester products in 2020 is around 1 million tons and adds: "When we consider Turkey's imports and the needs of Europe and North Africa, it is clear that our region needs much higher capacity. In order to meet this need to some extent, we decided to invest in our 350 thousand tons of fiber business and 350 thousand tons of Polyester chips production facility. We will put these businesses into operation at the end of 2023. Together with these businesses, our total investment amount will reach approximately 2.4 billion USD."

SEEKING ALTERNATIVES OUTSIDE CHINA: TURKEY

PTA is the main raw material of polyester. The domestic production of PTA is a detail that will largely end foreign dependency in terms of polyester production. Providing the first backward integration in the polyester value chain, SASA keeps some of the added value in Turkey.

Regarding the subject, Erdemoğlu says, “In this way, our domestic customers will be able to access raw materials under more favorable conditions. This will provide a competitive advantage in all polyester-using industries of Turkey, especially in the textile and packaging sectors.

It will bring Turkey forefront in the search for different alternatives outside of China, especially in the supply chain issues emerging in the pandemic environment."

Turkey's PTA import was approximately 1 million tons and consumption were approximately 1.1 million tons last year. The import of 2022 is expected to be approximately 1.5 million tons.

When SASA's business comes into operation in 2023, Turkey will maintain its position as an importer. With the PTA investment, Turkey's leading industries, especially the textile industry, will be paved the way.

Erdemoğlu Holding's PTA investment brings many firsts. In terms of raw material efficiency, it will be one of the most advanced facilities in the world in terms of technology and automation, with the highest energy efficiency, and the highest capacity.

With the businesses to be commissioned by the end of 2023, approximately 2.4 billion dollars will be invested in total.

World PTA capacity is approximately 90 million tons and production were 75 million tons as of the end of last year. Since the world PTA production growth rate is about twice the world growth rate, it carries forward all related industries with it.

The same is true in Turkey. PTA investment is a candidate to be the driving force of industries such as the textile and packaging industry.

SASA Polyester's Yumurtalık investment is around 12 billion dollars. With the plant of five million tons of Polyester, four million tons of PTA, 1.2 million tons of Polypropylene and Polyethylene, 600 thousand tons of PVC, foreign dependency on raw materials will be largely resolved.

Working life and workforce dynamics, which have been transformed by various crises and technological developments from the past to the present, have caused a different break in the world. After the COVID-19 outbreak, Erdemoğlu increased the total employment from approximately 1,250 to 4,200 with the investments of approximately 1 billion dollars in this period, regarding the new normal business strategies and actions, which are also on their agenda.

Erdemoglu says; "We did not experience any disruption in production as we fully implemented the concept of industry 4.0 in our new investments and provided full health measures. Our investments were not interrupted because we used electronic communication systems much more effectively with travel restrictions, on the contrary, they gained momentum with effective decision-making and implementation".

SASA's polyester capacity will be around 5 million tons by 2030. The growth will be in POY and yarn production, Polyester Fiber production, Industrial Polyester chips and Packaging grade polyester chips.

Since the production to be made at these capacities cannot be made using imported raw materials, raw material integration will also be ensured. Therefore, it will produce the polyester raw materials PTA and MEG, as well as other polymers that Turkey has to import, in its integrated facilities in Adana Yumurtalık.

Regarding the next period, Erdemoğlu says, "With the restructuring of the supply chain caused by COVTD19, we will realize the opportunity to become the main production center of all petrochemical products, especially polyester and raw materials, in the Mediterranean Basin and throughout Europe."

RISING INVESTMENT IN SASA

Which makes Sasa preferable to investors is raising the bar for growth. Its capital is 1 billion 120 million TL and 18 percent of its shares is publicly traded. Operating in the field of textile chemicals, Sasa is among the Borsa 30 index companies of Borsa İstanbul. The annual growth rates in the last five periods, announced by the company, have always been above 30 percent. The same performance continues in the announced quarterly 2021 balance sheet. In the first quarter of the year, the company increased its sales by 152 percent compared to the same period of the previous year, while its end-of-period profit increased by 56.59 percent.

HIGH YIELDS IN DOLLAR

Sasa made its investors happy with its high performance in the last five years. Stocks have always provided high yields in dollar in five years, except for the 2018 crisis. While the share price appreciated by 86% in dollar in 2016, the yield increased to 357 percent in 2017. After this high value increase in two years, it lost 24 percent in dollar in the 2018 crisis. Afterwards, it became a stock that investors followed with interest with its high performances in the first five months of 2019, 2020 and 2021.

SASA'S FINANCIAL DEVELOPMENT IN THE LAST 20 YEARS

In the 2000-2010 period, the company had sales of less than TL 1 billion and a structure that constantly made losses from its main activities. Afterwards, there was a clear development, with growing sales and an increase in core operating profitability evident in the 2010-2020 period. Its sales reached TL 1 billion in 2012 and maintained its ever-increasing momentum until 2020. In this process, the operating profitability of the company has grown continuously.

VALUATION RATIOS INCREASED

Data showing the balance between the company's income and profitability and the price of the share rose with the increasing interest. According to the available data, the price-earnings (P/E) ratio has risen to 102.50. The industry average is 47.92. This indicates that the interest in the stock is strong. On the other hand, it is among the statements that necessary studies are made for new investments related to capacity increase.

65 PERCENT OF THE SHARES ARE COLLECTED

360 million shares, corresponding to 65 percent of the publicly traded portion of Sasa, are in custody of Ak Yatırım. 6.62 percent is in custody of TEB Yatırım. The share of foreigners in the stock is 4.82%. With the change in the scope of MSCI Global Small Cap Indices on May 12, Turkey was excluded from the scope of the Index. Since the share of foreigners in the stock is not very significant, this change may not create a selling pressure on prices. However, it is worth reminding that even a one-point change in 4.82 percent is important.

EVALUATIONS OF BROKERAGE HOUSES

In the corporate evaluations following Sasa's first quarter financial results, mostly positive opinions came to the fore. Integral Yatırım stated that the company's quarterly financial results for 2021 were positive and drew attention to its rise in the last one and three months. According to the evaluation of the institution, it is understood that Sasa's financial results are appreciated. However, it is reminded that the stock is at a premium according to historical price multipliers. Despite all this, it expects the growth potential arising from his investments to continue. Gedik Yatırım, on the other hand, points out that the company's product sales volume has increased on an annual basis, with the contribution of rising polyester chip volumes.

HIGHLIGHTED IN INVESTOR EXPECTATIONS

In investor expectations, the size and potential that will emerge with the company's investments to be completed in 2023 stand out. Therefore, the expectations continue. It will be possible for the company to raise the bar for growth with the completion of its current investments. It is observed that the growth expectations are already reflected in the pricing in dollar.

AS A CONCLUSION

High market multipliers mean the stock has appreciated at current price levels. Despite the high rates in the indicators, the continued interest of the investor derived from the expectation that the increase in profit will continue. Currently, the company's investments continue. It is a real expectation that these investments will increase their sales and profitability with the completion of these investments. This situation allows the expectation of an increase in the stock to continue in the long term. Accelerating growth by increasing the company's operating profitability will ensure that it maintains its strength in the market. However, the strong rises in the recent period should not be interpreted as a continuation of the rise at the same pace in the upcoming period. The momentum can be maintained. However, the possibility of reductions in yields should not be ignored.

01 Jun 2021

Fortuna Turkey